Chart sample cheat sheets generally is a useful gizmo for traders or merchants who’re curious about buying and selling. They provide a handy reference information to the most typical chart patterns in monetary markets. One can use patterns to research potential developments, reversals, and buying and selling alternatives.

Buyers and merchants in right now’s fast-paced monetary markets should make selections shortly, sometimes with restricted data. Cheat sheets for chart patterns allow merchants to acknowledge and interpret them with better ease. They facilitate higher decision-making and provides fast entry to data that’s usually locked behind analysis carried out by technical analysts.

On this article, I’ll check out some chart sample cheat sheets and see how viable they’re for crypto buying and selling.

What Is a Chart Sample?

A chart sample is a recognizable formation of value actions on a monetary chart. Previous market information and present value motion of an asset, akin to cryptocurrency, may help detect potential developments, reversals, and buying and selling alternatives.

Chart patterns are a great tool for merchants. Whereas they are often deceptive on some events, they’re usually efficient at understanding and predicting future value actions. For instance, if you happen to establish a bearish sample just like the rising wedge sample, you’ll know there’s a chance that value ranges will go down.

3 Main Chart Sample Varieties

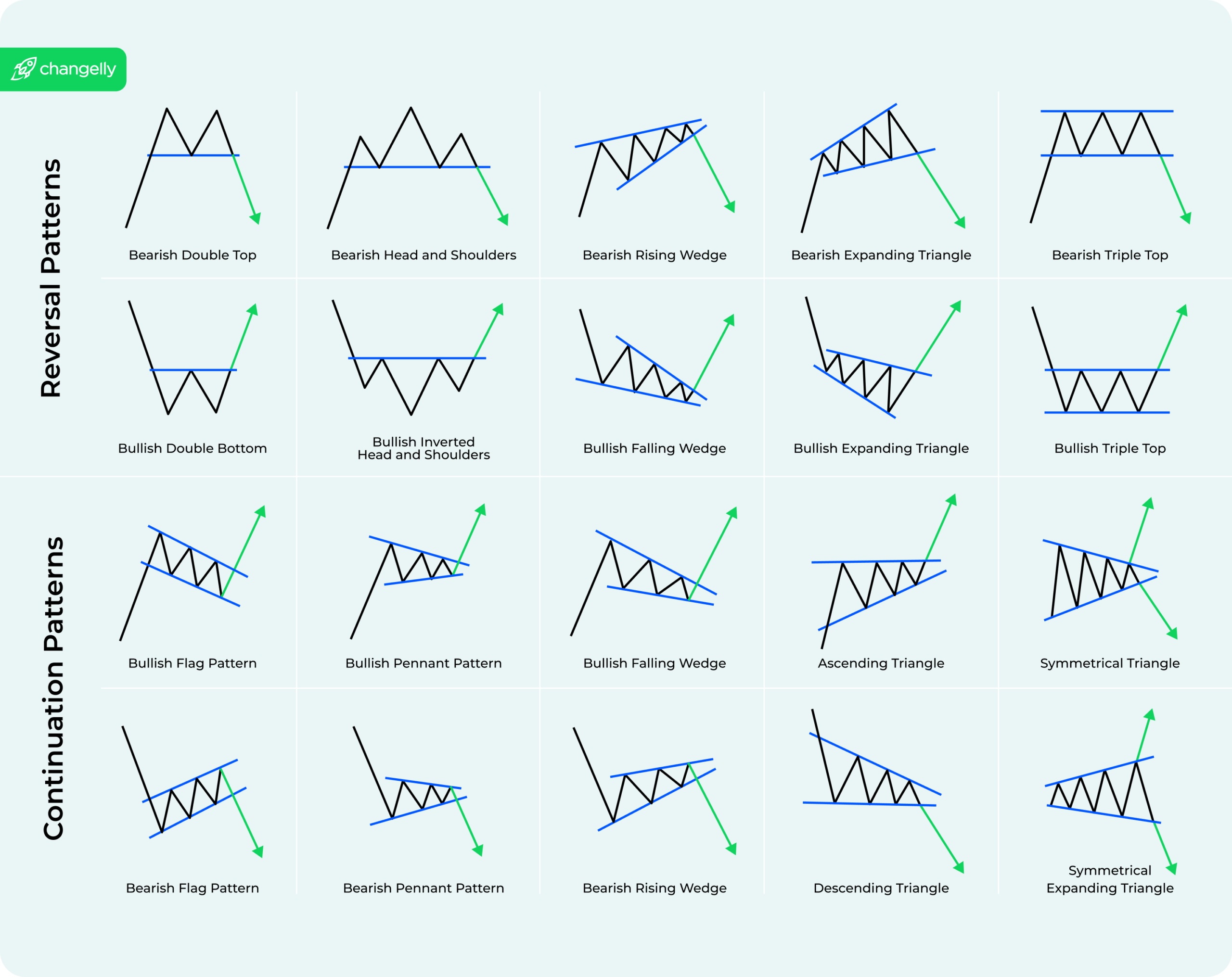

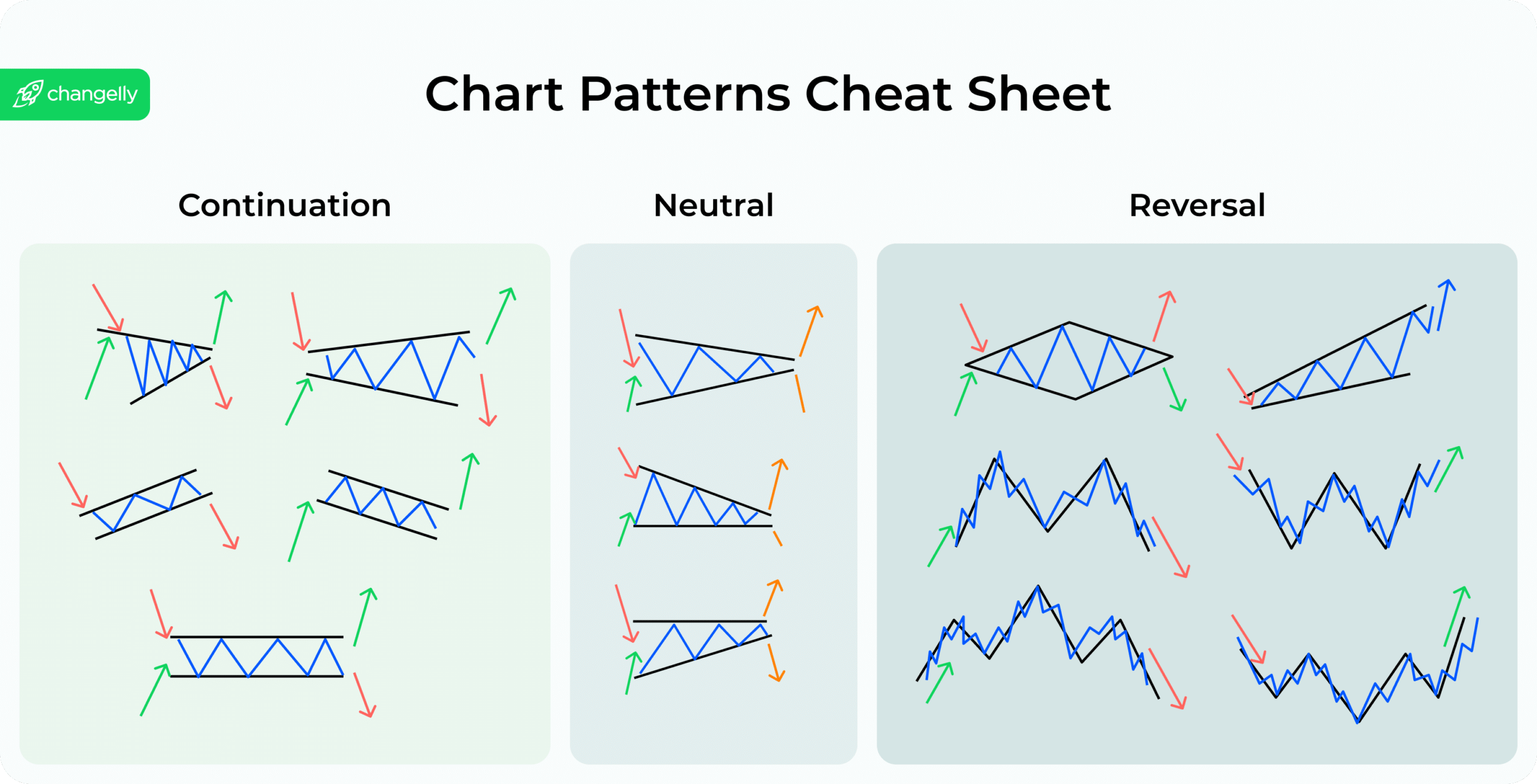

There are three important varieties of chart patterns: reversal, continuation, and bilateral. Right here is an summary of every of those varieties and a few examples.

Bilateral

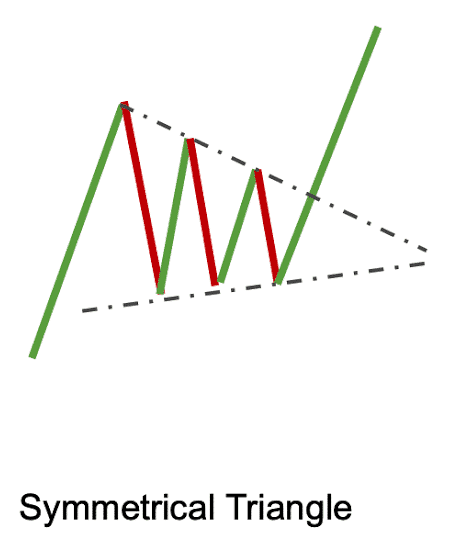

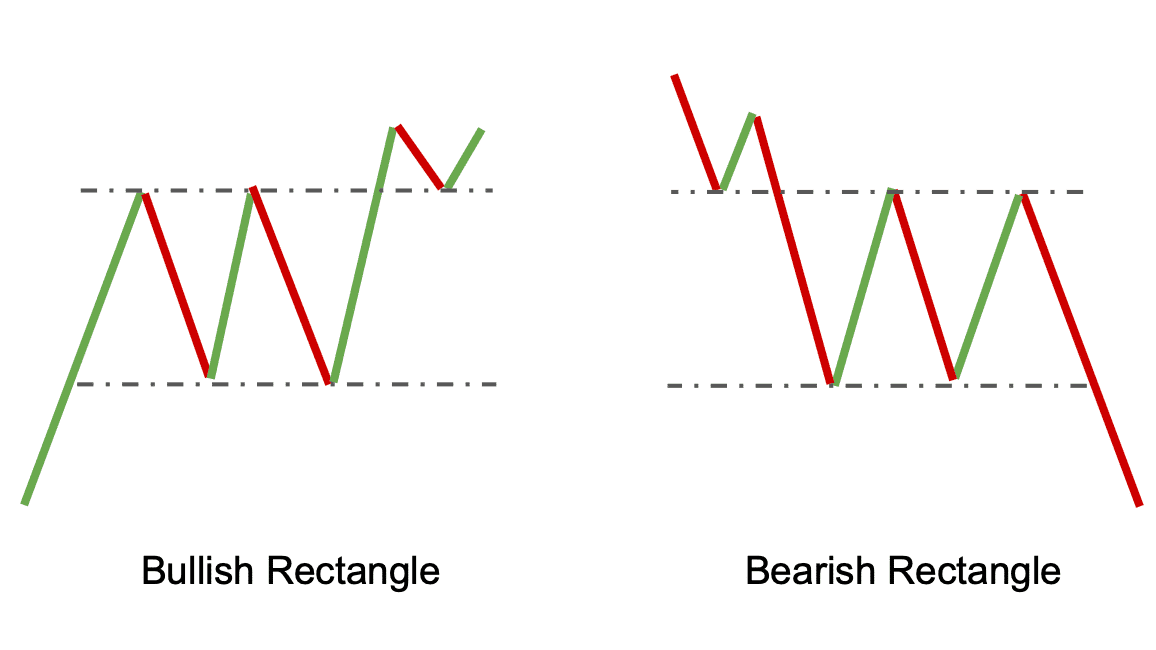

The market reveals a bilateral sample when consumers and sellers are unable to achieve a bonus. The sample that develops can lead to both the continuation or the reversal of the present pattern. Examples of bilateral patterns embody:

- Symmetrical Triangle. This bilateral chart sample is recognized when the worth is transferring in a spread, forming a triangle form with successive decrease highs and better lows. This impartial chart sample has no explicit route bias and might probably end in both a bullish or a bearish breakout.

- Rectangle. This sample emerges when the worth fluctuates inside two horizontal boundaries. The highest line serves as resistance, whereas the underside line serves as assist. This sample has the potential to end in both a bullish or a bearish breakout.

Continuation

A continuation chart sample can point out that there will likely be a interval of stagnation earlier than the worth regains its earlier momentum. It’s anticipated that the previous pattern will stay even after the sample is completed.

Listed here are some examples:

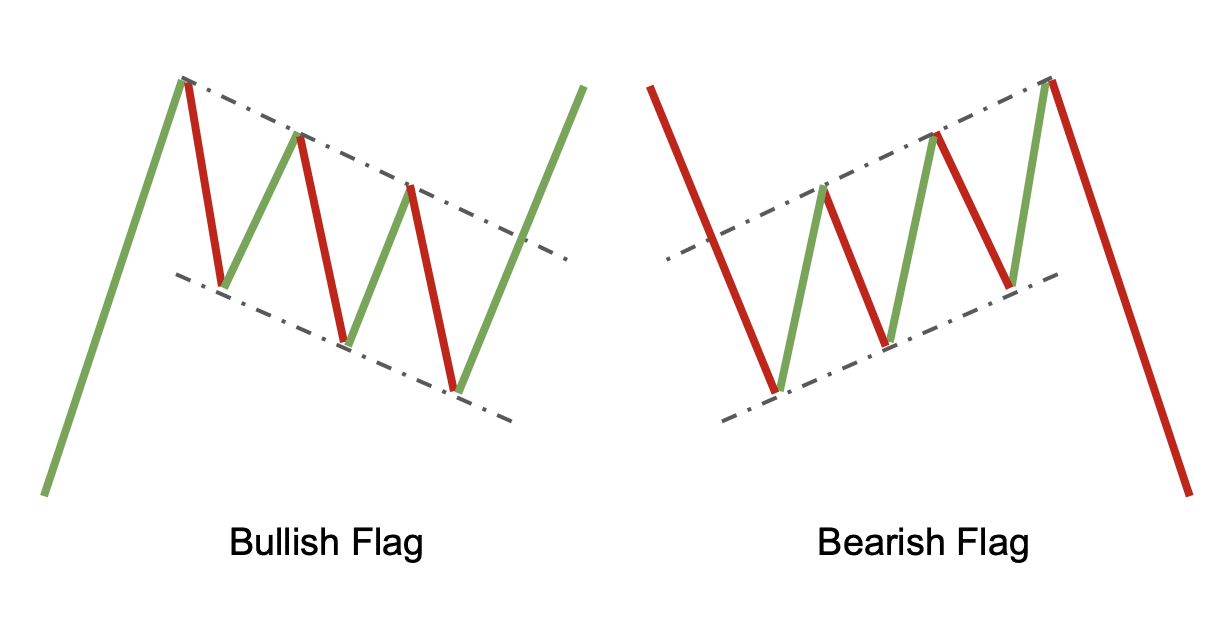

- Flags and Pennants. These bullish patterns sometimes are shaped after a pointy value transfer happens, the place the worth consolidates in a slender vary. Flag patterns have an oblong form, whereas then again, pennants are extra triangular in form. These continuation chart patterns are normally considered as indicators of a unbroken uptrend, indicating that the interval of consolidation is a short lived stabilization earlier than the pattern resumes.

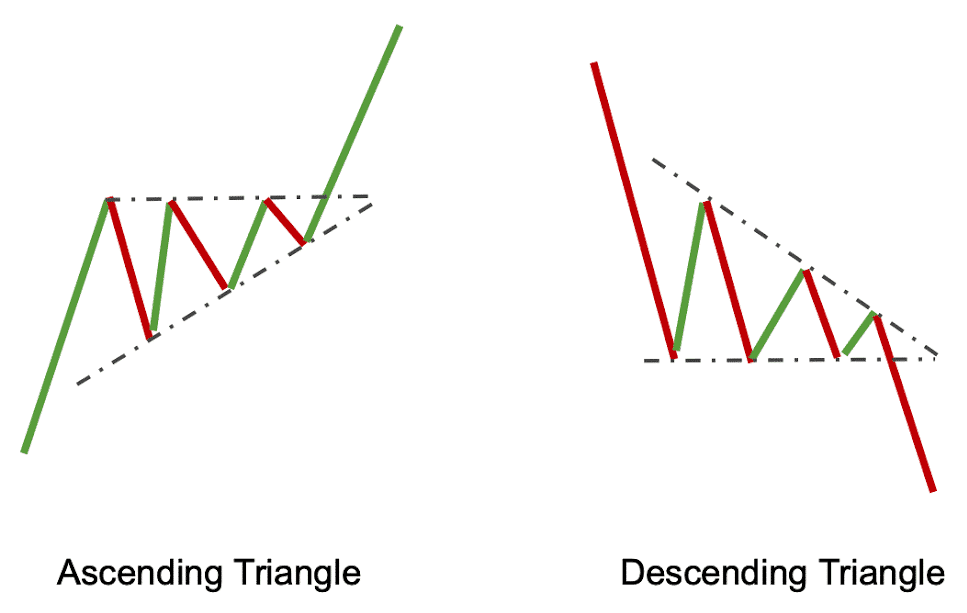

- Ascending and Descending Triangles. These patterns kind when the worth is transferring in a spread with a collection of upper lows or decrease highs. An ascending triangle has a flat prime and an upward-sloping backside trendline, whereas a descending triangle has a flat backside and a downward-sloping prime trendline. These bullish chart patterns are usually thought to be indicators of additional upward value developments.

Reversal

Reversal patterns might be employed to establish potential route modifications in market developments. Reversal patterns normally happen when a pattern is ending; they will sign a shift within the asset’s value. Some examples of reversal patterns are:

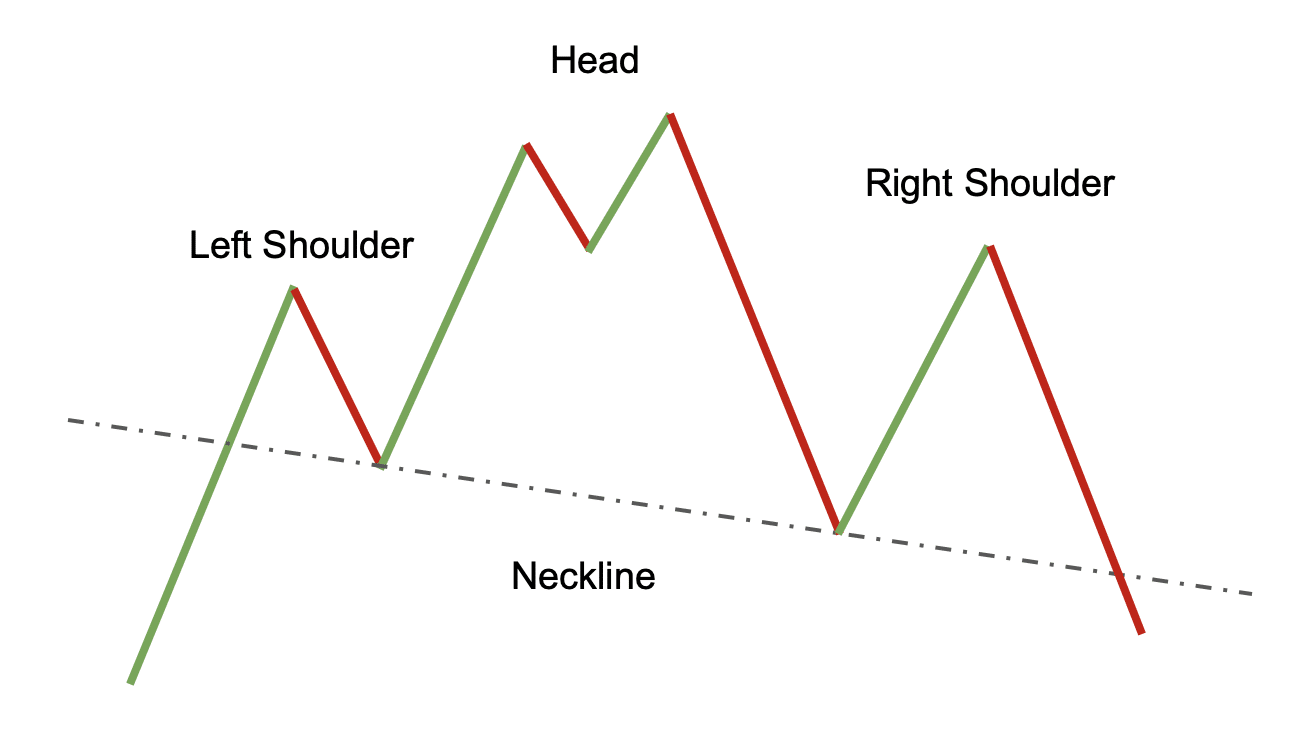

- Head and Shoulders. It is a triple peak sample that’s noticed when the worth reaches a peak, is then exceeded by a better peak, after which falls again to a decrease peak. It’s formed like a head with two shoulders. This sample is assessed as a bearish reversal sample.

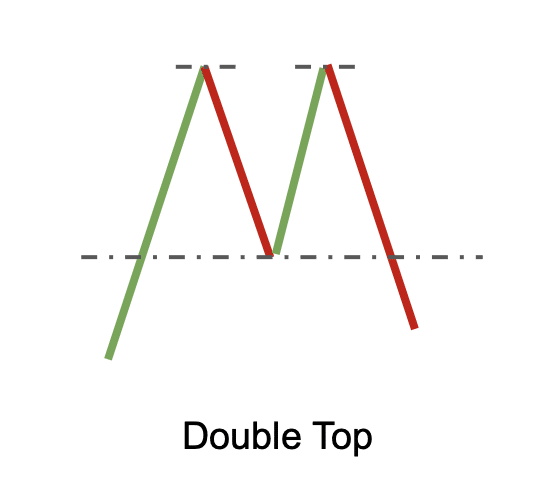

- Double Prime/Backside. This sample types when the worth reaches a excessive, pulls again, after which rises to an analogous excessive or falls to an analogous low. If this sample seems on the finish of an uptrend, it’s known as a bearish reversal. If it seems on the finish of a downtrend, it is called a bullish reversal.

What Is a Chart Patterns Cheat Sheet?

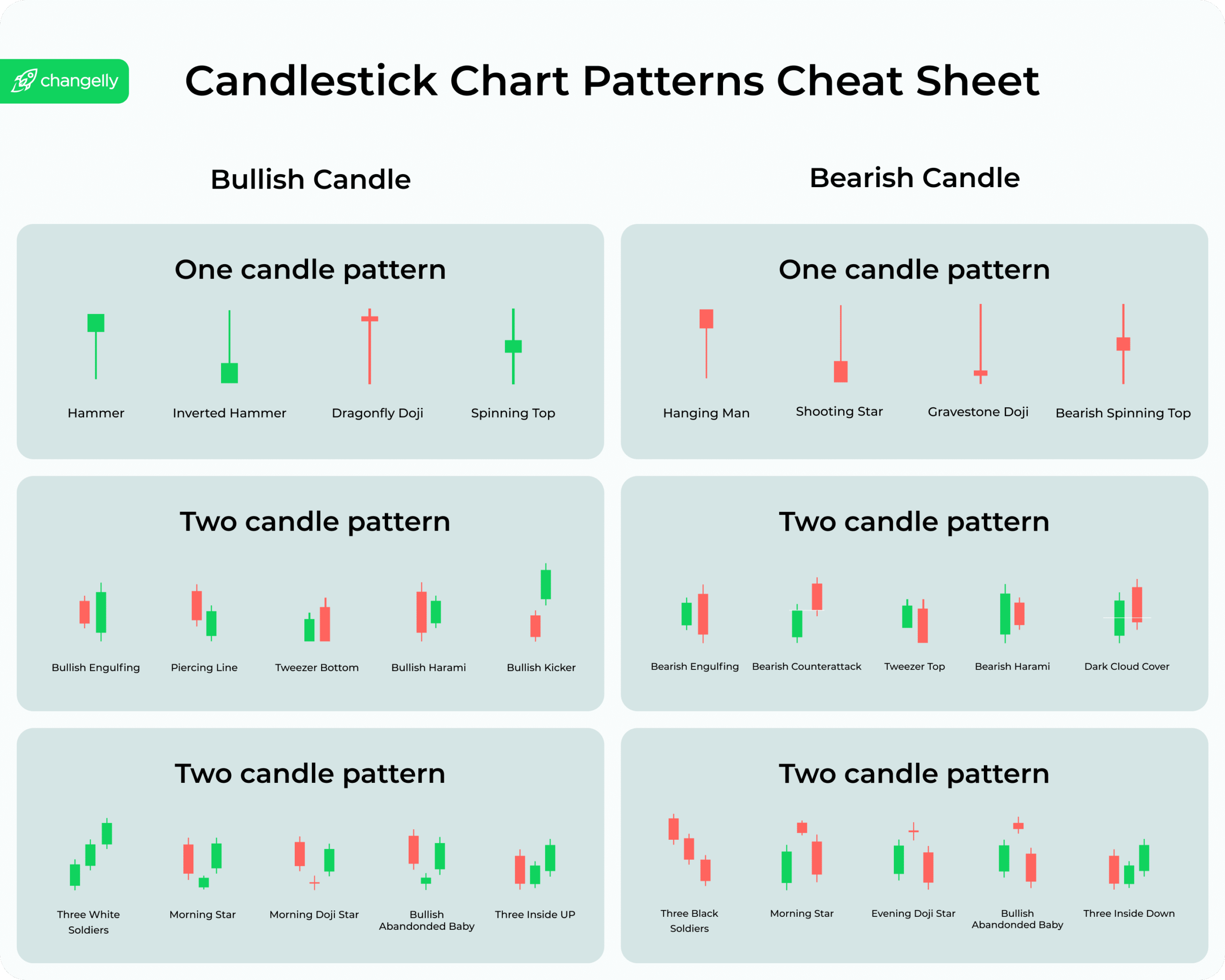

A chart sample cheat sheet is a great tool for buying and selling and technical evaluation that sums up varied chart patterns. It sometimes consists of the names of the patterns, a visible illustration of what they appear to be, and, typically, a quick description of their traits and what they will probably result in.

Cheat sheets can come in numerous codecs, together with however not restricted to:

- Printed or digital PDFs. These paperwork might be printed or downloaded to be used as a reference information. Being simply accessible on computer systems or cell units, printable crypto and foreign currency trading patterns cheat sheet PDF recordsdata make a handy device for merchants who want a bodily copy at hand.

- Buying and selling platforms. Some buying and selling platforms provide built-in cheat sheets that enable merchants to shortly entry data on charting patterns with out leaving the platform.

- Cell apps. Some cell apps additionally present built-in cheat sheets as a part of their options. This may be helpful for merchants who need to entry chart sample data on the go.

Right here is an instance of a chart patterns cheat sheet.

How Do You Use a Chart Sample Cheat Sheet?

Cheat sheets may help merchants of all ranges, from newcomers who’re simply studying their first chart patterns to skilled merchants who’re searching for an accessible reference information. Cheat sheets may help merchants save time and make higher buying and selling selections, even when they’ve recognized only a impartial sample.

Listed here are some recommendations on how you should use a chart patterns cheat sheet.

- Perceive the Fundamentals. Earlier than incorporating a chart patterns cheat sheet, it’s important to know not less than some fundamentals of technical evaluation, like what the fundamental traits of value charts are and the best way to establish assist and resistance ranges and plot pattern strains.

- Determine the Sample on a Chart. You’ll be able to both use the chart patterns cheat sheet to establish what’s going on within the chart at any second or select just a few buying and selling patterns you need to observe and search for them particularly. Both manner, use the cheat sheet to assist your self establish pattern route simply.

- Affirm the Sample. To confirm {that a} potential chart sample is legitimate, analyze further technical indicators akin to transferring averages, the relative power index (RSI), and quantity indicators.

- Acknowledge Potential Entry or Exit Factors. To take advantage of out of chart patterns, you have to to be taught when it is best to truly execute your trades. For instance, when figuring out a bullish flag continuation sample, the perfect second to open your lengthy place can be the purpose the place the worth breaks above the higher horizontal trendline. For a bearish reversal chart sample just like the night star, the entry level will likely be completely different: sometimes, will probably be close to the closing value of the third candle.

- Execute the Commerce. After verifying the chart sample, you may proceed to execute your commerce following your common technique. Set up cease loss and goal revenue ranges, and don’t overlook to intently monitor the commerce.

Combining a chart sample cheat sheet with different technical evaluation instruments and a buying and selling plan may help enhance your buying and selling outcomes.

Can Chart Patterns Cheat Sheets Change Technical Evaluation?

No, not even for absolute newcomers. Chart patterns (and, by extension, their cheat sheets) are only one facet of technical evaluation, which is a broader self-discipline that encompasses a variety of methods and instruments used to research market information and establish buying and selling alternatives.

Chart patterns may help achieve insights into value motion and market habits; nonetheless they will and ought to be utilized in mixture with different technical evaluation components, together with pattern strains, assist ranges, resistance ranges, transferring averages, and momentum indicators, to make an knowledgeable buying and selling resolution.

Chart patterns should not essentially dependable indicators, as they generally result in incorrect alerts or a failure to anticipate market actions accurately. Utilizing chart patterns in tandem with different technical evaluation instruments and making use of danger administration rules, akin to setting stop-loss orders, may help information buying and selling selections. Additionally it is necessary to handle place sizes and monitor market circumstances.

Chart Patterns Cheat Sheets and Crypto Buying and selling

Technical evaluation chart patterns generally is a useful device when observing the volatility and fast value actions generally present in cryptocurrency markets. Merchants and traders can use chart patterns to research the worth actions of cryptocurrencies and establish potential buying and selling alternatives.

Nonetheless, it’s price remembering that market circumstances and market habits current in cryptocurrencies don’t at all times mirror these of conventional industries, so chart patterns is probably not as dependable. When buying and selling crypto, it’s paramount to concentrate not solely to numerous technical indicators but additionally to the state of the market as a complete.

You will need to concentrate on the traits of every cryptocurrency and its buying and selling atmosphere previous to utilizing technical evaluation rules, as sure chart patterns might happen extra incessantly in some cryptocurrencies than others. Moreover, you need to be conscious of various markets — is it at present a bull or a bear market?

Crypto buying and selling requires warning, and technical evaluation ought to be thought of as just one component in a wide-ranging buying and selling plan. That stated, chart patterns might be helpful for recognizing potential alternatives.

FAQ

Are chart patterns dependable?

Chart patterns are a device utilized in technical evaluation that helps to foretell future market actions based mostly on historic developments. Their reliability can range considerably relying on components like market circumstances, time frames, and the particular asset being traded. Moreover, the end result you get from buying and selling chart patterns may even rely by yourself expertise as a dealer.

Whereas crypto chart patterns generally is a helpful a part of buying and selling methods, it’s necessary for merchants, particularly newcomers, to grasp that they aren’t foolproof and ought to be used together with different strategies like elementary evaluation and market sentiment evaluation.

Why do you want a chart sample cheat sheet?

A chart sample cheat sheet is a priceless useful resource for each skilled and newbie merchants because it gives a fast reference to numerous technical patterns utilized in chart evaluation.

A typical buying and selling sample cheat sheet normally consists of fundamental chart patterns, bearish and bullish developments, continuation patterns, and bilateral chart patterns. It might assist in figuring out potential breakout factors, understanding frequent patterns throughout completely different time frames, and refining buying and selling methods. Having all of the chart patterns summarized in a single place additionally helps in making fast knowledgeable selections.

What’s the most worthwhile chart sample?

Figuring out probably the most worthwhile chart sample might be subjective, because it usually depends upon the dealer’s particular person technique and market circumstances. Nevertheless, some merchants take into account patterns like the pinnacle and shoulders and double prime/backside as extremely dependable for predicting potential reversals. Continuation patterns, akin to flags and pennants, can be simply as helpful as bullish and bearish chart patterns.

A straightforward strategy to discover worthwhile chart patterns is to obtain a PDF or picture file that comprises an summary of the most typical chart buying and selling patterns.

What’s a Foreign exchange chart patterns cheat sheet?

A Foreign exchange chart patterns cheat sheet is a compilation of frequent patterns used particularly within the Foreign exchange (international alternate) market. This cheat sheet normally encompasses a wide range of technical patterns, together with fundamental, continuation, bilateral, and bullish and bearish chart patterns. It’s designed to assist merchants shortly establish and react to potential buying and selling alternatives in Forex.

This device is especially helpful as a result of Forex is understood for prime liquidity and volatility, requiring merchants to be adept at recognizing and responding to patterns in actual time.

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.