$WISE.L is a development firm, with the profitability of a money cow, and the valuation of a sluggish grower.

Key Highlights:

- Smart provides worthwhile development in a rising area of interest

- The corporate is constructing a large moat and sharing the advantages with its shoppers

- In a worst-case state of affairs, returns could be optimistic

The enterprise:

WISE is an organization that facilitates worldwide cash transfers. They presently have a market share of lower than 5% of cash moved by individuals, and fewer than 1% of the market share of cash moved by small companies.

Supply: Firm’s FY 2025 earnings launch

For additional reference concerning the enterprise, you’ll be able to verify THIS earlier put up by @Rayeiris, shared beforehand, and that describes completely every thing about WISE.

How they’re constructing their moat:

Worldwide cash transfers have been traditionally very pricey for people. As an expat, I’ve skilled this earlier than. The charges that Smart’s opponents cost to prospects are unrealistically costly, however there was no various till Smart arrived. You would suppose that, to be a worthwhile firm, the take charges (what the corporate earns with every transaction) ought to be excessive. However as a matter of reality, Smart has been rising income and rising earnings whereas decreasing take charges.

Supply: Firm’s FY 2025 earnings launch

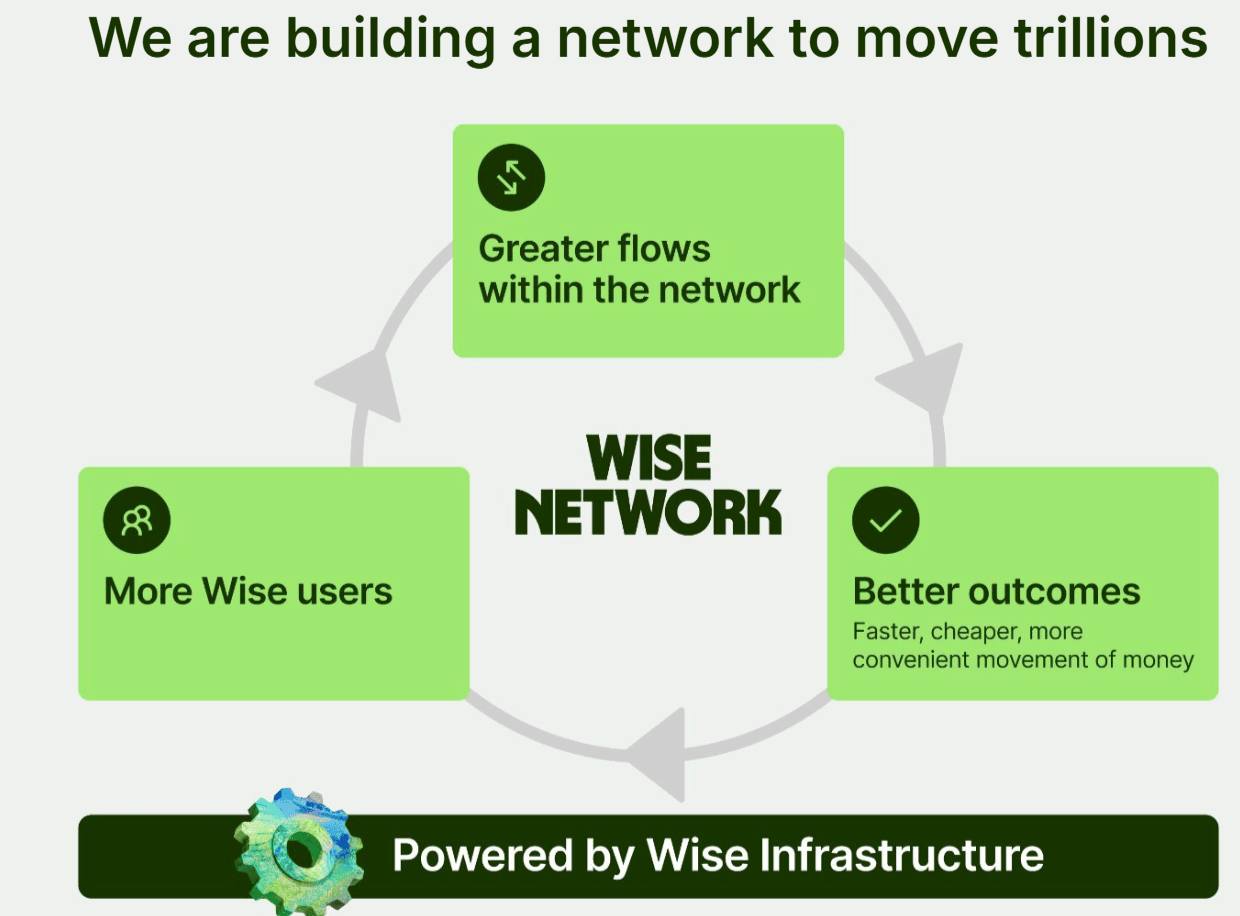

It is a confirmed solution to develop a MOAT: You get advantages from scale, and also you share it with prospects. Clients see the advantages and use your product extra, bringing extra advantages for the corporate which can be shared with the shopper. It’s a virtuous circle that feeds itself.

Supply: Firm’s FY 2025 earnings launch

That is how Costco used to construct its MOAT. And it has labored splendidly for them through the years. However there’s a lot extra to it than solely cash transfers for people.

The corporate can be increasing into new merchandise, like its Smart account for companies. They’re additionally together with new options like fast pay with a QR code. However extra importantly, with Smart Platform, companies, banks, and different organizations can profit from Smart’s infrastructure to switch cash overseas. Firms like Morgan Stanley, NU, Commonplace Chartered, or Google Pay have already joined, displaying the potential of this product.

Valuation:

The corporate has established a long-term underlying revenue of 13%-16%, which is decrease than its present underlying revenue margin (24%). With a income development of 15%-20%, and an curiosity revenue development of 10%-20% (presently over 70% year-over-year), the risk-reward ratio appears to be like very compelling.

This principally signifies that within the worst-case state of affairs, with a PE ratio of 20 instances earnings (which is a derating from its present a number of of over 28 instances), the corporate will ship an annual return of 1.77%. Alternatively, if the corporate retains delivering development and profitability, with a PE ratio of 30 instances earnings, the corporate might ship a yearly return of over 20% per 12 months.

Dangers:

- Income slowdown

- Decrease rates of interest

All valuations take into account income development and development within the curiosity revenue above 1%. If rates of interest go down considerably, this portion of the revenue might vanish. Additionally, if extra opponents, together with huge banks, enter the sphere with aggressive costs, income might be flat, and the revenue margin might be harmed.

Mitigating dangers:

- Money and time-consuming course of for opponents to catch up

- Development in balances held by prospects

Smart has constructed a robust moat for greater than 8 years now. If a competitor wished to copy this, it might be time-consuming and costly. Additionally, even when cash might speed up the method for a competitor to get the place Smart is, a few of the work shouldn’t be about constructing the infrastructure itself, however about negotiating with third events and native regulatory our bodies, which is a sluggish course of.

Relating to a decrease rate of interest state of affairs, it could be offset by increased balances held by prospects. Really, within the present atmosphere, though rates of interest are falling, the corporate is rising its curiosity revenue on account of increased balances, which can seemingly be sustained sooner or later.

Conclusion:

Smart is probably a multibagger. A top quality enterprise creating a large moat whereas being very worthwhile. Given the area of interest the corporate is aiming at, competitors is scarce and provides worse situations than Smart. Any competitor eager to compete presently would wish to sacrifice profitability for a very long time.

Catalysts:

- Incorporation of extra firms into its Smart Platform, particularly banks

- Sustained development

- Stabilization of its take charge

I personal a place in $WISE.L on the time of writing.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index, or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.