“That everyone might obtain one thing with out anybody having to pay,” wrote Vilfredo Pareto (1848-1923), the Italian polymath, on the illusory attract of protectionism as the perfect vote-catcher.

As any British college pupil finding out historical past will know, the repeal of the 1815 Corn Legal guidelines in 1846 below UK prime minister Robert Peel marked a turning level within the nation’s financial coverage. They might additionally bear in mind that Adam Smith’s The Wealth of Nations (1776) laid the theoretical foundations for that shift towards free commerce. Fewer—until they’re finding out economics—are prone to be aware of David Ricardo’s Ideas of Political Financial system and Taxation (1817), which offered a extra formal concept of comparative benefit that has stood the check of time as a mannequin for understanding the advantages of worldwide commerce.

Over the 2 centuries since, as the worldwide inhabitants has elevated fivefold, per capita revenue has risen greater than eightfold—over 15 instances the speed of the earlier 800 years. In brief: commerce enriches.

Tariff risk

All this gives trigger for concern within the wake of US President Donald Trump’s new world tariffs, introduced in August, which elevate import taxes on items to their highest degree since 1933, based on Yale College’s Finances Lab. Because the world’s largest financial system, the US consumes roughly one-third of world items and companies, making such coverage shifts vital for all. This contains the artwork commerce; the US has been the world’s largest artwork market since no less than the Second World Battle.

Trump’s said goals included import substitution, job creation, elevated tax revenues and finally the discount of world tariffs. Nonetheless, most economists predict the other: a contraction in commerce, rising costs, and potential job losses relying on the worldwide response.

This raises a number of vital questions: Why does this matter to the artwork market? What can we be taught from historical past? And the way may this non permanent or everlasting setback be overcome?

All through its historical past, the artwork market has thrived on monetary surpluses and the free motion of products and folks—each of that are merchandise of worldwide commerce. The market tends to flourish in periods of inhabitants development, financial enlargement and free commerce, particularly towards the tip of an financial cycle. Because the Nineteen Sixties, when worldwide commerce in artwork and collectibles was first systematically measured, the market has grown with every passing decade, typically in increased bursts of two to a few years. Over that point, the variety of international locations collaborating within the worldwide artwork commerce has elevated fivefold, with a number of growing economies rising as main gamers.

How protectionism impacts the artwork market

Historical past gives two key durations wherein tariffs clearly affected the artwork market: the late Nineteenth to early twentieth centuries, and the inter-war years of the Nineteen Twenties and 30s.

Within the first interval, tariffs amongst 35 international locations rose from the 1860s, reaching over 15% by the Eighties and into the 1910s—notably in Latin America and peripheral Europe. Within the US, import tariffs have been raised in 1861, peaking at 47% later that decade, earlier than stabilising at a mean of 20% to 30% by 1913. Dutiable import tariffs peaked at 52% in 1897. Elsewhere, international locations akin to Russia, Spain, Japan, Sweden, France, Italy and Austria-Hungary selectively raised tariffs from 1875, reaching ranges of 20% to 84% by 1913. In contrast, the UK maintained a coverage of free commerce, whereas the Netherlands, Belgium and Switzerland saved tariffs comparatively low.

Protectionist considering on this period drew on earlier financial writings, notably of Alexander Hamilton within the US and Friedrich Checklist in Germany. Their arguments targeted on nurturing “toddler industries” and selling the nation-state over world integration. Language traits in English-language books help this shift in sentiment: using the phrase “protectionism” rose steadily from 1840 to 1910, accelerating in subsequent many years. Conversely, the phrase “free commerce” gained floor from 1790 to 1870 earlier than petering out and declining by 1910.

The US loved sure benefits throughout this era: an enormous home market, comparatively low worldwide dependency and a practice of isolationism. Tariffs have been a main supply of federal revenue till the First World Battle. Customs revenues have been truly increased in actual phrases in 1913 than in 1835. Certainly, common US tariffs within the Nineteenth century have been increased than at any time since—till Trump’s latest proposals.

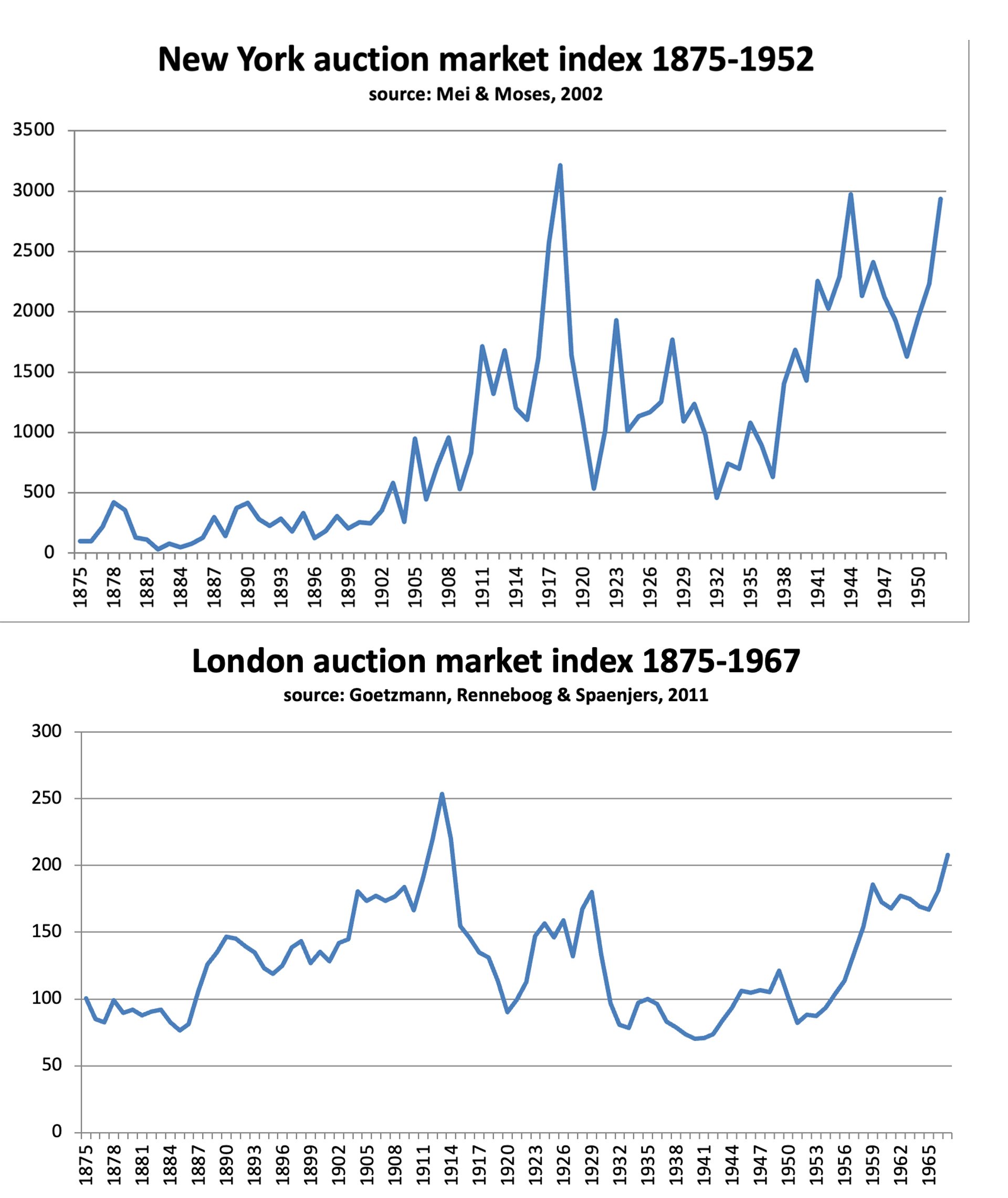

Whereas different elements additionally influenced the artwork market—akin to home taxation and cultural preferences—it’s clear that protectionism created a extra risky, much less assured worldwide enterprise local weather. Within the UK, artwork imports boomed within the 1850s and 70s however declined because the “lengthy despair” of the late Nineteenth century set in. Public sale numbers surged within the 1850s and once more from 1874 to 1888, peaking by 1913. In continental Europe, extra protectionist economies noticed public sale development from 1870 to a peak in 1883, adopted by a bigger surge from 1901 to 1913. Public sale costs mirrored this volatility: after rising in Britain from the 1840s, they slumped in 1875-85, surged and fell once more in 1891-1901, and hit a a lot increased peak in 1913. Within the US, public sale worth cycles have been extra frequent and subdued till round 1903, after which they rose to a peak in 1918—as tariffs fell to their lowest in a century.

The catastrophe of the Nice Melancholy

The second period of protectionism is extra acquainted, although overshadowed by the Nice Melancholy, of which it was a contributing issue. US tariffs, lowered after the First World Battle, have been reintroduced in 1922 and steadily elevated by way of the last decade, culminating within the Smoot-Hawley Tariff Act of 1930—a coverage that the famous British civil servant Arthur Salter would later name “a turning level in world historical past”. These measures largely aimed to guard American agriculture, which had suffered a boom-bust cycle from 1915 to 1929.

The end result was disastrous. World commerce collapsed by 25% between 1929 and 1934 on account of increased tariffs, import quotas and forex controls. The 1934 Reciprocal Commerce Agreements Act aimed to reverse a few of the injury. In the meantime, international locations together with the UK launched even increased tariffs than the US, making an attempt to guard themselves from deflation whereas constrained by mounted trade charges below the Gold Commonplace. The Gold Commonplace turned the premise of the worldwide forex system from 1873 with the purpose of stabilising costs and facilitating borrowing. Finally, those that deserted the gold peg and pursued expansive financial coverage recovered quicker.

This financial turbulence harmed the artwork market—although much less so within the UK and the US than throughout the earlier period. Within the UK, public sale costs fell by over half after peaking in 1913, doubled within the Nineteen Twenties, then collapsed once more after 1929. They solely recovered to their 1929 degree by 1959—and to their 1913 degree by 1967. Within the US, costs peaked in 1918, fluctuated till 1929, fell sharply between 1929 and 1932, then recovered in phases in 1933 and 1935, reaching a better peak in 1941. Nevertheless it took till 1953 to return to 1918 ranges.

Totally different sectors of the market have been affected in numerous methods. The previous adage that collectors purchase new works in good instances and Previous Masters in arduous instances held true. Within the Nineteenth century, the Previous Grasp market thrived from 1815 to the Eighties, whereas the British college of portraiture held on into the twentieth century. The first market peaked within the UK within the 1860s however gave solution to European artwork, which might not be appreciated on resale till many years later. Museum constructing in Britain additionally buoyed the market.

The Nineteen Twenties noticed dramatic shifts in style: the Barbizon college and John Singer Sargent fell out of trend, whereas 18th- and early Nineteenth-century British artists—Reynolds, Gainsborough, Constable and Turner—rose in recognition. Within the Thirties public sale turnover declined general. Rembrandt and Van Dyck pale in demand, whereas the Italian Primitives, Sixteenth-century Venetians and Rubens and different Seventeenth-century Dutch painters gained floor. In the meantime, Impressionism started an extended ascent in worth, and Trendy artwork attracted rising curiosity, mirrored in museum acquisitions on the time.

Earnings diversification

The first market was equally dynamic. Regardless of hardship, Modernism flourished throughout Europe, the US and Asia. Many artists supplemented their incomes by way of design, promoting and instructing, but the Thirties nonetheless noticed main exhibitions of Picasso and the emergence of a brand new era of American Modernists—laying the groundwork for the post-war artwork increase below renewed free commerce.

Within the current, it’s to be hoped that President Trump’s tariff experiment will finally be reversed or result in decrease world tariffs, as occurred in earlier episodes of protectionism. If not, we would take inspiration from the resilience of the Thirties artwork world, when artists, sellers, auctioneers and curators tailored and diversified to outlive—producing, promoting and exhibiting works that spoke to each disaster and hope.

In at this time’s context, we could discover ourselves shopping for extra artwork from much less acquainted areas of the world, albeit with fewer alternatives to resell into the dominant US market—and thereby at decrease costs. Nonetheless, because the developed world plus China ages and slows, and as youthful, faster-growing economies increase, that technique could show smart in the long term.