The discussions surrounding Ripple’s strategic growth have reached a fever pitch, with analysts suggesting that the crypto funds firm could also be positioning itself to faucet into a brand new $12 trillion United States (US) repo market. Latest studies and acquisitions trace that Ripple’s rising ambition to bridge digital belongings with Wall Avenue’s largest liquidity programs might considerably affect XRP’s utility past cross-border funds.

Ripple Eyes Entry Into $12 Trillion Repo Market

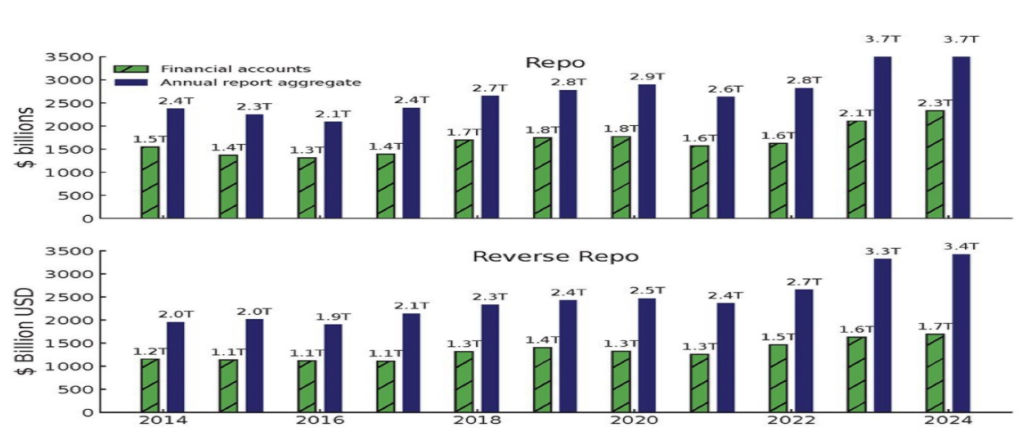

A current X publish by a crypto analyst generally known as ‘X Finance Bull’ has ignited discussions within the crypto group, claiming that Ripple’s newest acquisitions sign a direct entry into the US repo market. Opposite to the beforehand cited $6 trillion valuation, the professional disclosed that the repo market’s precise worth could also be almost twice as excessive, approaching $12 trillion and making it one of many largest liquidity swimming pools on the planet.

The repo market, which X Finance Bull calls the “actual liquidity spine of the worldwide finance system,” performs an important function in facilitating short-term funding and liquidity all through worldwide economies. Ripple’s strategic entrance into this area might mark a brand new chapter in how capital strikes throughout borders and establishments. Furthermore, the analyst talked about that Ripple’s current acquisition of cloud-based SaaS platform, GTreasury and prime brokerage Hidden Street seems to be pivotal in its technique to faucet into the $12 trillion repo market.

In response to the analyst, these strikes lengthen Ripple’s attain past conventional remittance and cross-border fee options, unlocking idle capital that resides inside among the world’s strongest monetary markets. GTreasury, for one, offers Ripple entry to stylish capital administration infrastructures. Mixed with Hidden Street, the crypto firm now sits on the intersection of conventional finance and digital asset liquidity.

X Finance Bull harassed that Ripple is constructing “the inspiration of recent financial plumbing,” and now it’s paired with 24/7, 365-day real-time settlement powered by a decentralized ledger. He urged market observers to not focus solely on the XRP value however on Ripple’s strategic positioning.

Ripple CEO Broadcasts Full Acquisition Of Hidden Street

Ripple CEO Brad Garlinghouse introduced on October 24 that the corporate has formally finalized the acquisition of Hidden Street, which can now function beneath the title “Ripple Prime.” This growth marks the crypto agency’s fifth main acquisition in roughly two years, becoming a member of GTreasury final week, Rail in August 2025, Customary Custody in 2024, and Metaco in 2023.

With these acquisitions, Garlinghouse revealed that Ripple is constructing options towards enabling an “web of worth.” The CEO reminded the group that XRP stays central to each side of Ripple’s increasing community. The launch of Ripple Prime additionally marks a major milestone, making Ripple the first-ever cryptocurrency agency to personal and function a worldwide, multi-asset prime brokerage.

Featured picture from Wallup, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.