Bitcoin (BTC) is struggling to carry the $110,000 help stage as worth stress intensifies heading into the ultimate days of the month. Market construction stays fragile following latest volatility, and a number of other analysts warn that BTC might nonetheless retest decrease demand zones earlier than establishing a stronger base. With liquidity pockets sitting under present worth and sellers displaying persistence close to resistance, short-term draw back can’t be dominated out as merchants reassess positioning after the Federal Reserve’s coverage shift.

Nonetheless, not all alerts level to weak point. Many traders stay optimistic as macroeconomic situations start favoring threat property as soon as once more. The Fed’s latest 25bps price lower and affirmation that quantitative tightening will finish by December 1st have laid the groundwork for what some view because the early section of a brand new liquidity cycle — traditionally constructive for Bitcoin’s long-term trajectory.

On-chain information additionally helps a calmer market setting. Over the previous month, the exercise of outdated cash has remained average, with long-term holders displaying no indicators of panic promoting. This habits suggests conviction amongst seasoned market individuals, whilst BTC navigates short-term turbulence. Collectively, these dynamics body a market in transition: tactically cautious, but strategically positioned for potential upside.

Low ASOL Exercise Indicators Sturdy Holder Conviction

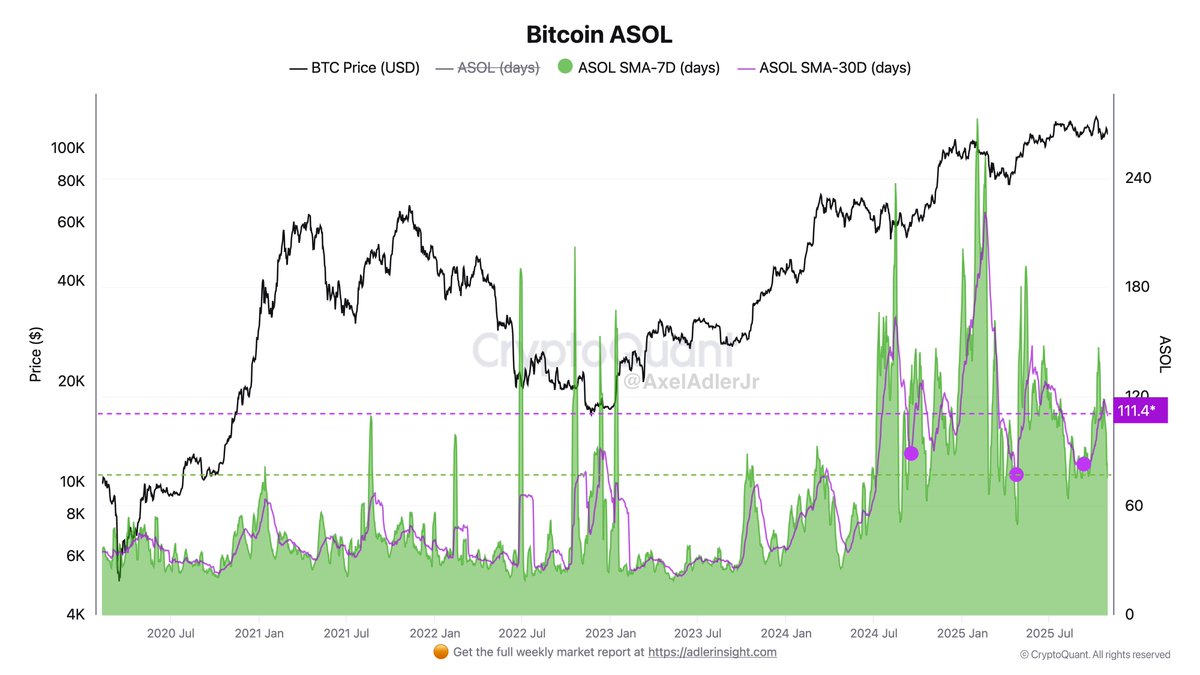

Based on on-chain insights highlighted by high analyst Axel Adler, Bitcoin’s latest spending habits amongst long-term holders stays remarkably steady, underscoring robust market conviction whilst worth struggles to carry above key help. Adler factors to the Common Spent Output Lifespan (ASOL) — a metric that measures the common age of cash being moved on-chain — noting that whereas there have been short-lived upticks to 245 days on October 8 and 209 days on October 21, these alerts had been far weaker than the heavy long-term holder exercise seen in spring and June.

This distinction is essential: throughout these earlier durations, older cash transferring signaled significant distribution occasions, typically previous corrective phases. In distinction, the latest delicate will increase point out no widespread need amongst long-term holders to exit positions. The 30-day ASOL transferring common at present sits close to 111 days, which Adler characterizes as a structural baseline — a zone in keeping with wholesome consolidation fairly than distribution.

In sensible phrases, this implies seasoned holders stay affected person, displaying no urgency to take earnings, regardless of macro uncertainty and short-term volatility. On the similar time, incoming liquidity continues to soak up provide, as referenced on this week’s Substack commentary. This absorption dynamic is essential: it displays a market the place obtainable Bitcoin is regularly tightening, enabling worth stability whilst speculative flows stay constrained.

Collectively, these on-chain situations recommend a foundational section fairly than exhaustion. As liquidity improves and macro headwinds ease, this quiet conviction amongst long-term holders might kind the groundwork for the following vital leg increased — as soon as demand meaningfully re-accelerates. For now, the market stays calm beneath the floor, a posture traditionally related to accumulation phases and future enlargement fairly than broader distribution or capitulation.

Bitcoin Holds Above $110K However Faces Rejections Under Resistance

Bitcoin (BTC) is buying and selling close to $110,100, making an attempt to stabilize after one other sharp rejection from the $117,500 resistance space — a stage that has persistently capped upside makes an attempt since mid-August. The 12-hour chart exhibits a repeat sample: every transfer towards the higher vary fades close to the cluster of transferring averages, with sellers stepping in aggressively at resistance and forcing BTC again into its mid-range help zone.

BTC is at present holding above a key demand band between $108,500 and $110,000, an space that beforehand acted as a pivot throughout late-September and early-October worth motion. Sustaining this zone is crucial for bulls. A breakdown right here would expose Bitcoin to the $104,000–$106,000 area, the place worth depraved throughout the October 10 liquidation flush.

On the upside, a structural shift requires BTC to reclaim the 50- and 100-period transferring averages on the 12h timeframe and set up a foothold above $114,500. Solely then would momentum construct for an additional check of $117,500, with a confirmed breakout opening a path towards $120,000–$123,000.

For now, Bitcoin stays range-bound, caught between macro optimism and lingering provide stress. With volatility compressing once more, the following robust transfer is prone to come as soon as the market digests latest coverage shifts and liquidity flows start redirecting decisively.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.