Knowledge exhibits Bitcoin spot exchange-traded funds (ETFs) are down $3.29 billion from their all-time excessive (ATH) after the newest wave of outflows.

Bitcoin Spot ETFs Are Experiencing Their Second-Largest Drawdown Ever

In a brand new put up on X, CryptoQuant group analyst Maartunn has talked about how the holdings connected to the US Bitcoin spot ETFs are presently trying. Spot ETFs confer with funding automobiles that permit an investor to realize publicity to an underlying asset’s value actions with out having to immediately personal mentioned asset.

Within the context of cryptocurrencies, because of this the ETF holder by no means has to work together with a digital asset trade or make any transactions on the blockchain; the fund buys and holds the coin on their behalf. Spot ETFs are a comparatively latest phenomenon within the sector, having acquired approval from the US Securities and Trade Fee (SEC) solely in January of final yr.

Regardless of them being new, these funding automobiles have grown into one of many cornerstones of the market, tapping into the demand from conventional traders who have been beforehand reluctant to commerce on-chain. Given the relevance of the spot ETFs, the pattern of their holdings may be value maintaining a tally of, as it could replicate the sentiment amongst institutional entities. A method to take action is by measuring the place these funds stand relative to their ATH.

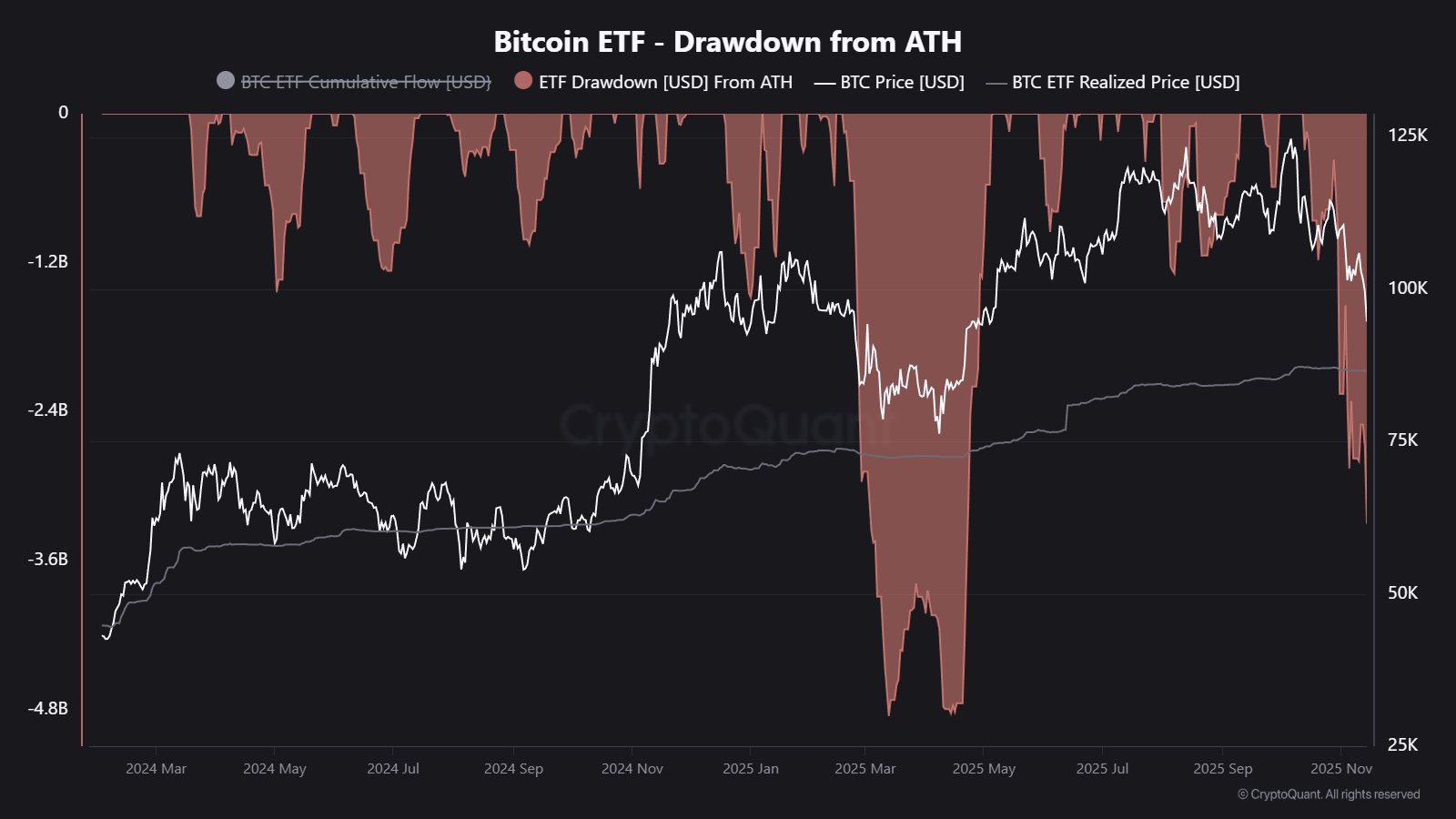

Under is the chart shared by Maartunn that exhibits how the drawdown from the ATH presently seems to be for the Bitcoin spot ETFs:

Appears to be like just like the drawdown has deepened in latest days | Supply: @JA_Maartun on X

From the graph, it’s seen that the Bitcoin spot ETFs noticed their USD holdings attain an ATH in October, however since then, they’ve been dealing with a sustained drawdown. Final month, the drawdown was nonetheless restricted, however the outflows accompanying the value crash have meant ETF holdings are actually considerably down in comparison with the height.

Extra particularly, spot ETF holdings are presently down a whopping $3.29 billion, the second-largest drawdown since final yr’s launch. The one part throughout which the metric’s worth was larger was the bearish interval between February and April. Again then, ETFs noticed a peak drawdown of $4.8 billion. The newest decline in ETF holdings continues to be notably under this mark, so it solely stays to be seen whether or not the drawdown will deepen within the close to future.

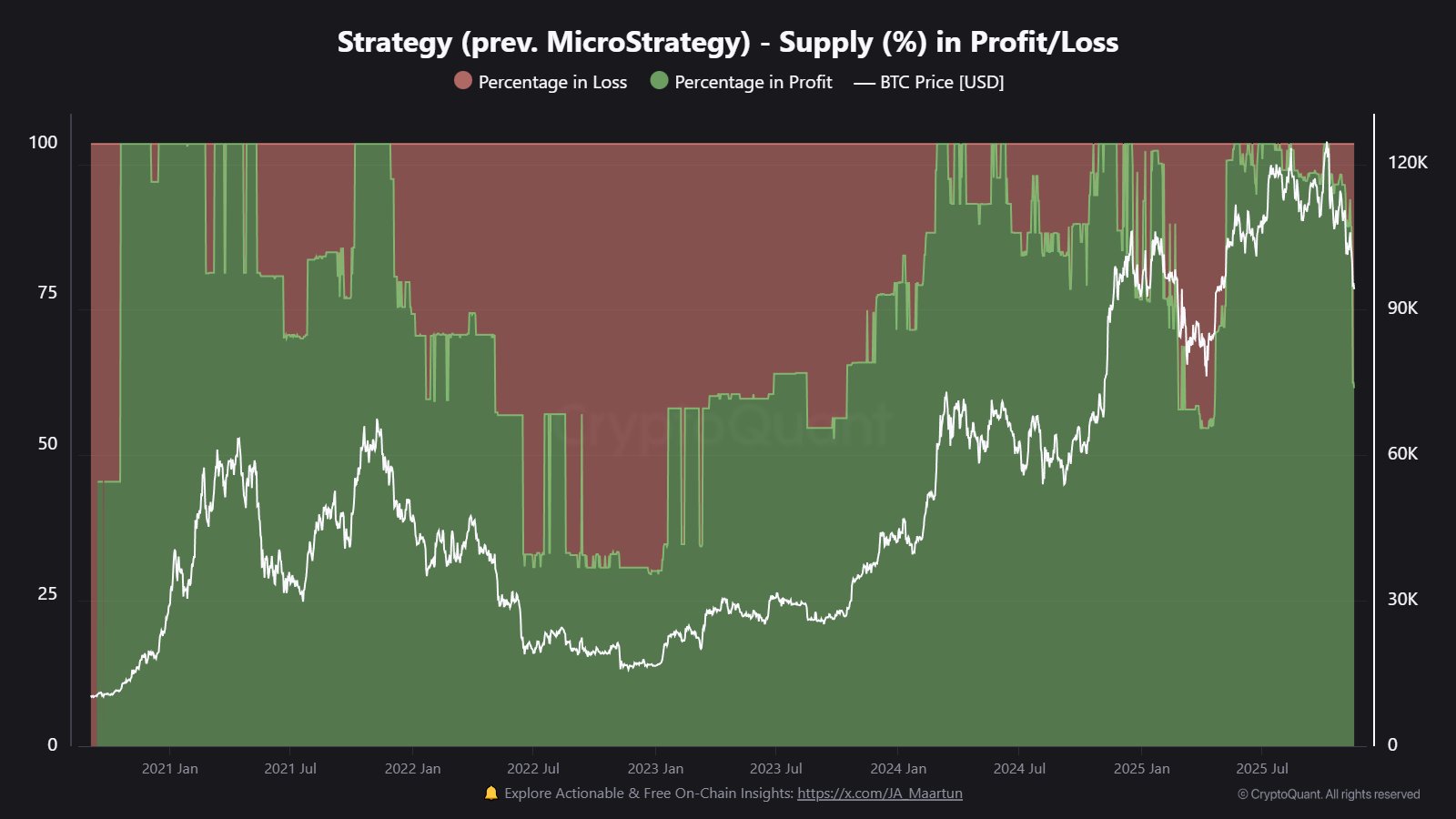

In another information, Technique made a big buy on Monday, however the continued decline within the Bitcoin value has already pushed the treasury agency’s new acquisition considerably into the pink. In keeping with CryptoQuant, the mix of this transfer and the value drop has resulted in about 40% of the corporate’s reserves now sitting underwater.

The profit-loss breakdown of Technique's provide | Supply: CryptoQuant on X

BTC Value

Bitcoin slipped beneath $90,000 simply earlier, however the coin has since bounced again to $91,500.

The value of the coin appears to have been transferring down | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.