The MicroStrategy MSCI removing session threatens Technique (MSTR) with index expulsion over its 649,870 BTC holdings. JPMorgan warns of $2.8B-$8.8B in compelled passive fund outflows if the MicroStrategy MSCI removing proceeds.

KEY TAKEAWAYS:

- MSCI overview threatens main outflows attributable to Technique’s heavy Bitcoin focus.

- Technique’s software program income is actual however tiny beside $70B in Bitcoin holdings.

- End result could reshape how corporates construction and classify digital-asset treasuries.

The MicroStrategy MSCI removing risk locations Technique (NASDAQ: MSTR)—the enterprise software program firm previously referred to as MicroStrategy—liable to expulsion from MSCI fairness indices attributable to its large Bitcoin treasury holdings. The index supplier is conducting a public session on whether or not corporations with digital asset publicity exceeding 50% of their steadiness sheets ought to stay eligible for benchmark inclusion. Technique’s 649,870 BTC place, at the moment valued at over $70 billion, locations it squarely within the crosshairs of this coverage overview.

JPMorgan estimates that MSCI removing alone would power passive index funds to promote roughly $2.8 billion in Technique shares, as reported by Investing.com. If S&P Dow Jones and FTSE Russell undertake comparable thresholds, mixed outflows may attain $8.8 billion. With public session closing December 31, 2025, and a last resolution anticipated January 15, 2026, the end result carries important implications for Technique’s inventory value, passive fund flows, and doubtlessly Bitcoin market liquidity.

MSCI, a significant index supplier that influences billions in passive funding funds, is reviewing whether or not corporations whose digital asset publicity exceeds 50% of their whole holdings ought to stay eligible for inclusion in its fairness indices. This session locations Technique (previously MicroStrategy), the most important company Bitcoin holder, on the heart of a attainable market-moving resolution.

Be aware: Technique is the present identify of the corporate previously referred to as MicroStrategy, efficient Feb. 5, 2025. The MSTR ticker image stays unchanged on NASDAQ. All through this text, we use “Technique” as the first model identify whereas referencing its MicroStrategy legacy the place related for search context and reader readability.

Why the MSCI Choice Issues

Technique’s (previously MicroStrategy) steadiness sheet contains 649,870 BTC, at the moment valued at greater than $70 billion, making it one of many world’s largest company Bitcoin holders. The dimensions locations the corporate among the many largest company holders of Bitcoin worldwide, a standing resembling what’s described as Bitcoin whale conduct in digital asset markets, holders whose transaction sizes can considerably affect market liquidity and value motion.

If MSCI removes Technique from its indices, the corporate itself is not going to be compelled to promote any Bitcoin. Nevertheless, index funds could be compelled to promote Technique inventory. These necessary reductions may weaken liquidity (ease of shopping for and promoting) in Technique’s inventory and doubtlessly stress Bitcoin costs, particularly affecting different corporations holding Bitcoin of their treasuries.

Nevertheless, the MicroStrategy MSCI removing would set off necessary rebalancing throughout a whole bunch of passive funds, creating concentrated promoting stress.

Michael Saylor’s Protection: Technique Stays a Software program Firm

MicroStrategy founder Michael Saylor has argued publicly that Technique (MSTR) stays a real enterprise software program enterprise and shouldn’t be handled as a pure Bitcoin proxy. In a put up on X, he said that the corporate generates roughly $500 million per yr from software program services and products. He frames Bitcoin not as a passive holding however as an asset that strengthens the agency’s total monetary place.

His declare attracts assist from the newest quarterly submitting. Throughout Q3 2025, Technique reported $128.7 million in software program income. This determine represents a ten.9% enhance over the prior yr. At that quarterly price, the enterprise generates about $515 million yearly. These operations embrace enterprise analytics instruments, subscription providers, and long-established buyer relationships. By itself, the software program division is a sturdy and functioning enterprise.

The software program division’s regular development happens as extra firms discover Bitcoin treasury methods, looking for to know whether or not twin enterprise fashions can coexist inside conventional fairness market classifications. Saylor thus argues that MSCI’s methodology fails to account for the operational actuality of the corporate. He maintains that Bitcoin and software program operate collectively inside a single company structure fairly than representing separate identities.

Verification: What the Numbers Truly Present

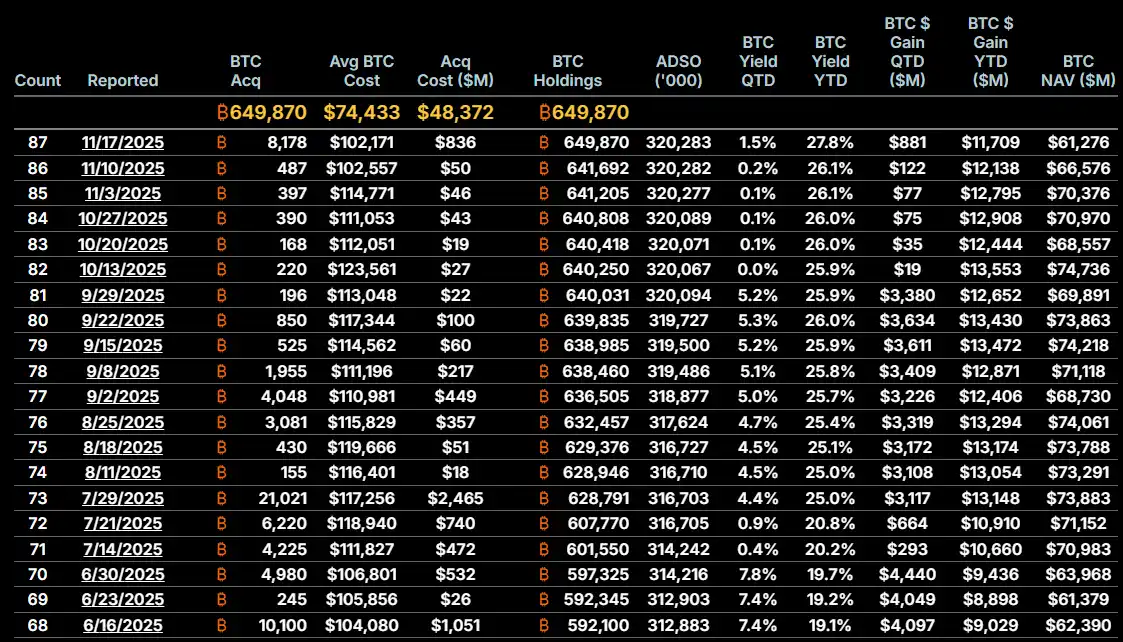

Technique has been persistently shopping for BTC all through the cycle Credit score: Technique

To guage Saylor’s protection, the evaluation will depend on inspecting each income contribution and steadiness sheet publicity. Software program income is verifiable and significant. The enterprise delivers $515 million yearly and continues to develop at a gentle price. This output reveals precise operations supported by actual clients and recurring contracts. When it comes to precise enterprise operations, the division stays lively and commercially related.

Nevertheless, software program income doesn’t totally offset the size of Technique’s Bitcoin publicity. The corporate holds greater than $70 billion in Bitcoin in opposition to roughly $515 million in annualized software program income. Bitcoin subsequently dominates the steadiness sheet by a margin that exceeds 99%. MSCI’s session focuses on asset focus fairly than income or operational scale. Beneath that framework, Technique’s Bitcoin place far surpasses the 50% threshold underneath overview.

Broader Implications for Company Bitcoin Treasury Fashions

Technique has been essentially the most seen firm pursuing a Bitcoin-heavy treasury mannequin since 2020. Its public success and high-profile acquisitions have influenced different corporations to discover comparable methods. Some data-intensive corporations now maintain digital property equal to greater than half of their market capitalization, as reported within the Crypto Information characteristic on Hyperscale Information’s treasury.

For particular person buyers questioning how one can purchase Bitcoin amid this institutional adoption development, the infrastructure has matured considerably since Technique started accumulating in 2020.

The choice additionally comes at a time when extra firms are exploring the usage of Bitcoin inside treasury and financing operations. Curiosity in Bitcoin-collateralized credit score is rising, and corporations throughout varied sectors are beginning to discover digital property as long-term strategic investments, prompting questions on correct regulatory classification.

If MSCI confirms its proposal, corporations with excessive Bitcoin positions could face incentives to restructure treasury preparations to stay index eligible. Potential changes embrace transferring Bitcoin to subsidiaries, creating separate treasury entities, or diversifying holdings to cut back focus threat. The overview might also immediate extra readability on how digital property match inside conventional frameworks of company classification.

The session additionally raises questions on what Bitcoin represents in company finance contexts, as a treasury reserve asset versus as a speculative funding. As extra corporations undertake Bitcoin as a part of their long-term methods, definitions of asset class, threat classification, and company identification are being examined.

MicroStrategy MSCI Removing Timeline: What Comes Subsequent

The MSCI session stays open till December 31, 2025. The ultimate resolution is predicted on January 15, 2026. If Technique (MSTR) is faraway from MSCI indices, passive fund outflows may start inside days as index funds rebalance their holdings. The MicroStrategy MSCI removing would mark one of many largest index-driven liquidations triggered by cryptocurrency publicity.

Understanding how Bitcoin halving cycles affect company treasury accumulation timing might also issue into Technique’s future buy patterns, no matter index eligibility outcomes.

The MicroStrategy MSCI removing resolution represents a watershed second for company Bitcoin treasury methods. If finalized, the precedent would basically reshape how index suppliers consider corporations with important digital asset publicity.

At current, the info assist three clear conclusions. Saylor’s software program income declare is correct. MSCI’s focus concern is legitimate primarily based on the steadiness sheet. The result of the session will decide which fact in the end carries higher weight.

Written by Peter Macharia, Edited by Zoran Spirkovski.

MicroStrategy MSCI Removing: Continuously Requested Questions

What’s Technique’s relationship to MicroStrategy?

Technique (NASDAQ: MSTR) is the rebranded identify of MicroStrategy, the enterprise analytics software program firm based by Michael Saylor in 1989. The corporate modified its identify to “Technique” in February 2025, however the MSTR ticker image stays unchanged. The corporate maintains each its legacy enterprise software program enterprise (roughly $515 million in annual income) and its Bitcoin treasury technique (649,870 BTC valued at over $57 billion).

How a lot Bitcoin does Technique (MicroStrategy) personal?

As of Nov. 25, 2025, Technique owns 649,870 BTC, valued at greater than $57 billion at present costs. This makes Technique the most important company Bitcoin holder globally, a place accrued via constant purchases since August 2020 underneath founder Michael Saylor’s “Bitcoin for Companies” technique.

Will Technique (MSTR) be faraway from MSCI indices?

MSCI is consulting on whether or not corporations with digital asset publicity exceeding 50% of their steadiness sheet ought to stay index eligible. Technique’s Bitcoin holdings exceed 99% of its whole property. The choice might be introduced Jan. 15, 2026, after the general public session interval closes Dec. 31, 2025. MSCI has not pre-announced the end result.

What occurs if Technique is faraway from MSCI indices?

Passive index funds that monitor MSCI benchmarks could be required to promote their Technique (MSTR) holdings to keep up correct index alignment. JPMorgan estimates MSCI removing would set off roughly $2.8 billion in compelled promoting. If S&P Dow Jones Indices and FTSE Russell undertake comparable insurance policies, mixed outflows may attain $8.8 billion. The MicroStrategy MSCI removing would doubtless impression Technique’s inventory value via this compelled promoting stress, although the corporate itself wouldn’t be required to promote any Bitcoin.

Does Technique need to promote its Bitcoin if faraway from indices?

No. Index removing impacts solely passive fund holdings of Technique inventory, not Technique’s company Bitcoin treasury. The corporate’s 649,870 BTC would stay on its steadiness sheet no matter index classification. Nevertheless, sustained inventory value stress from compelled promoting may theoretically complicate future capital raises if Technique wished to amass extra Bitcoin.

When was Technique’s (MicroStrategy’s) final Bitcoin buy?

Technique’s most up-to-date Bitcoin buy occurred on Nov. 17, 2025, when the corporate acquired 8,178 BTC for roughly $836 million at a mean value of $102,171 per Bitcoin.

Is Technique nonetheless a software program firm?

Sure. Technique generates roughly $515 million in annual income from enterprise analytics software program merchandise, with Q3 2025 software program income of $128.7 million representing 10.9% year-over-year development. The corporate serves enterprise clients with enterprise intelligence, analytics, and cloud-based information platforms. Nevertheless, Bitcoin holdings now signify greater than 99% of the corporate’s steadiness sheet by worth, creating the classification query on the heart of the MSCI overview.

What different corporations maintain important Bitcoin of their treasury?

Moreover Technique’s 649,870 BTC, notable company Bitcoin holders embrace Tesla (nonetheless holds Bitcoin after 2021 purchases), Block (previously Sq., Jack Dorsey’s funds firm), and rising corporations pursuing Bitcoin treasury methods. Nevertheless, no public firm approaches Technique’s Bitcoin focus degree relative to market capitalization.

How can I monitor Technique’s Bitcoin holdings?

Technique publishes Bitcoin acquisition bulletins via SEC Type 8-Okay filings out there on the SEC’s EDGAR database. The corporate additionally maintains a Bitcoin tracker on its investor relations web site exhibiting whole holdings, common buy value, and yield-to-date metrics. Third-party trackers like BitcoinTreasuries.org additionally keep real-time company Bitcoin holding databases.

What’s Michael Saylor’s view on the MSCI overview?

MicroStrategy founder Michael Saylor has publicly defended Technique’s index eligibility, arguing that the corporate generates actual software program income ($515 million yearly) and that Bitcoin features as a treasury asset that strengthens the general monetary place. In a put up on X on Nov. 21, 2025, Saylor said that Technique shouldn’t be a fund, not a belief, and never a holding firm, however a publicly traded working firm with a singular treasury technique that makes use of Bitcoin as productive capital. He has not indicated Technique would cut back Bitcoin holdings to keep up index eligibility.