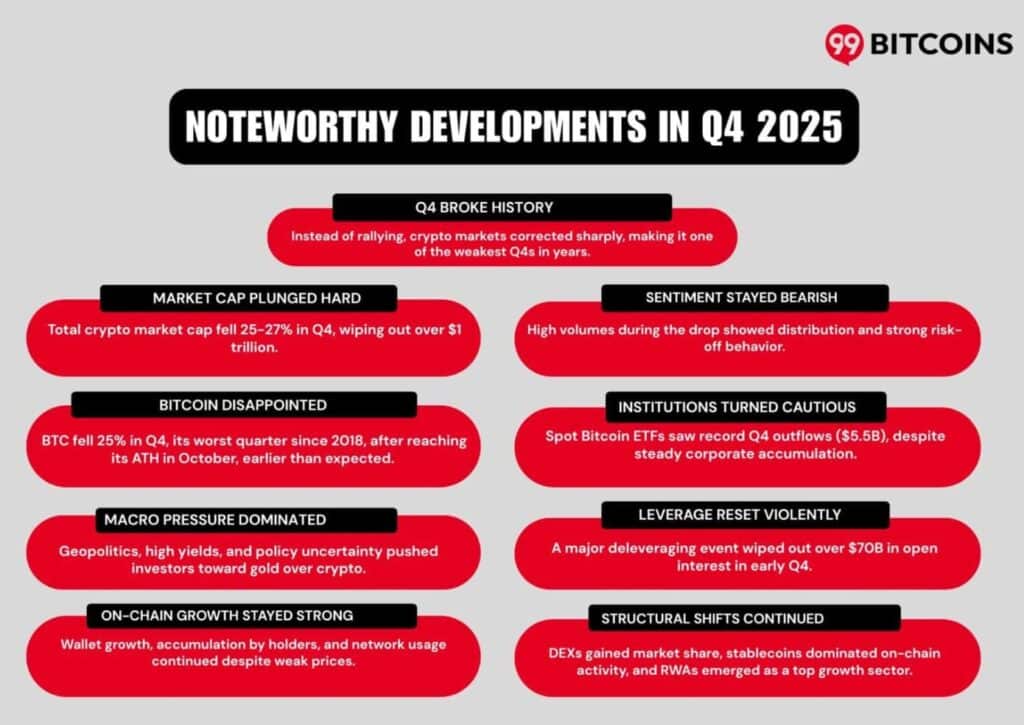

This fall 2025 broke crypto’s long-standing seasonal script. As an alternative of a year-end rally, the market offered off onerous, dragging the entire crypto market cap right down to roughly $2.9 trillion. It pushed Bitcoin from October highs into the low-$80,000s. The brand new 99Bitcoins This fall 2025 State of Crypto Market Report, in collaboration with Crypto.com, frames the transfer as a risk-off “distributions” quarter – excessive quantity, falling costs, and cautious positioning throughout spot ETFs and derivatives.

In accordance with the report, “Buyers this quarter have been extra centered on preserving their capital than attempting to commerce the market.” In 99Bitcoins’ estimate, complete crypto market cap fell 25-27% quarter-on-quarter – one of many steepest QoQ drops of the yr.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

So What Really Drove The Promote-Off In This fall 2025?

Bitcoin’s correction adopted all-time highs in October 2025. It was a speedy slide from round $126,000 to the low $80,000 vary. Nevertheless, the report argues that the decline occurred with elevated buying and selling volumes – typically signifying a late-cycle distribution relatively than a quiet drift decrease. Macro sensitivity additionally dominated late This fall, with value motion reacting to US inflation prints and broader threat urge for food. All this saved merchants defensive.

“Though BTC ETFs had beforehand attracted robust institutional flows earlier within the yr, This fall noticed ETF outflows speed up, and futures open curiosity remained excessive whilst costs fell,” the report stated.

“Digital Asset Treasury” corporations expanded holdings with Bitcoin comprising the bulk share of their reported crypto NAV.

Discover: 99Bitcoins’ This fall 2025 State of Crypto Market Report

Underneath-the-hood shifts: Stablecoins, DEX Share, Derivatives Leverage

Whilst costs fell, stablecoins continued cementing their function as crypto’s transactional spine, representing 30% of on-chain transaction quantity and surpassing $4trillion year-to-date quantity in 2025, in keeping with the report.

“This surge in stablecoin utilization has instantly fueled progress in crypto-collateralized lending, which reached a brand new all-time excessive by the top of Q3 2025, overtaking the earlier peak set in This fall 2021,” the report stated.

Structural market share additionally saved migrating: the DEX-to-CEX spot commerce ratio rose towards the low-20% vary by end-2025.

And what does all of this arrange for 2026? The report’s base case is just not “straight up.” It’s a market which will see steadier progress if institutional adoption and regulatory readability enhance.

However in the intervening time, any push above $95,000 looks as if a present. If it does, the ensuing momentum might simply propel the BTC USD value nicely above the psychological $100,000 mark. Contemplating the optimistic correlation between BTC and among the altcoins, count on some high quality tokens to soar within the course of. That is what some analysts count on to occur within the subsequent few weeks, if not days.

Discover: Bitcoin BTC USD Worth Eyes $100K on Wall Road Shopping for

Key Takeaways

-

The 99Bitcoins report identified that buying and selling exercise remained robust, with complete quantity reaching $887.3 billion over the previous 30 days. Michael Saylor’s Technique continued to dominate the panorama, holding an unmatched 660,624 BTC.

-

“Bitcoin considerably outperformed altcoins over the yr. Within the first half, many buyers anticipated an altcoin season, with capital rotating out of Bitcoin and into altcoins, however this shift by no means occurred.”

The submit Crypto’s “Finest Quarter” Didn’t Present Up: This fall 2025 Wiped $1T As Bitcoin Slid And Establishments Cut up appeared first on 99Bitcoins.